Monetize Virtual Funds: Unlocking the Potential of Crypto Trading

In today’s rapidly evolving digital landscape, monetizing virtual funds has become a key focus for investors and entrepreneurs alike. As cryptocurrencies surge in popularity, individuals are increasingly turning towards crypto trading as a viable way to generate income. This article aims to explore the intricate world of crypto trading, offering strategic insights and tips on how to effectively manage and maximize your investments.

Understanding Crypto Trading

Crypto trading involves the buying and selling of digital currencies through online exchanges. This exchange of virtual assets allows traders to capitalize on price fluctuations within the market, creating an opportunity to earn profits. The fundamental principles of trading apply here—knowledge of market trends, analysis of historical data, and strategic planning are all instrumental in developing a successful trading strategy.

The Importance of Research

Before diving into crypto trading, it is essential to conduct comprehensive research. Understanding market behaviors, the technology behind digital currencies, and external factors influencing price changes will equip you with the tools needed to monetize virtual funds effectively.

Key Areas of Research

- Market Trends: Consistently monitor price trends and historical performance of cryptocurrencies.

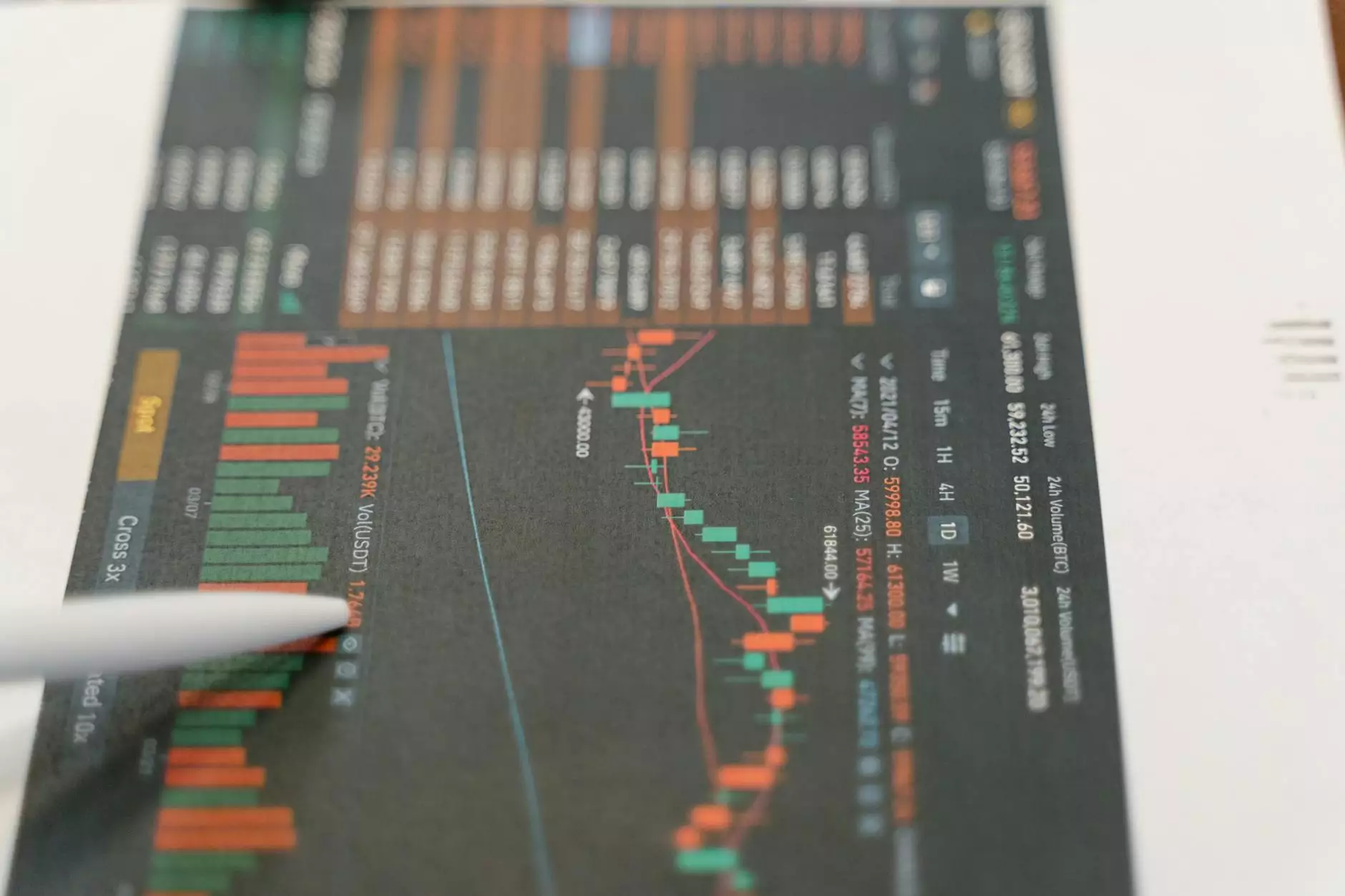

- Technical Analysis: Utilize charts and indicators to predict future price movements.

- Fundamental Analysis: Evaluate the underlying technology and economic factors of different cryptocurrencies.

- Market News: Stay updated on regulatory changes, technological advancements, and global economic factors impacting cryptocurrencies.

Strategies for Successful Trading

To maximally monetize virtual funds, implementing solid trading strategies is crucial. Here are some effective approaches used by seasoned traders:

1. Day Trading

Day trading involves executing trades within the same day to capitalize on small price fluctuations. It requires a keen sense of market movements and quick decision-making abilities.

2. Swing Trading

This strategy focuses on taking advantage of price "swings" in the market. Swing traders typically hold their assets for several days or weeks, allowing time for significant price movements to occur.

3. HODLing

Coined from a misspelled forum post, "HODL" implies a long-term investment strategy. By purchasing cryptocurrencies and holding onto them during market volatility, investors aim to profit from long-term price appreciation.

4. Arbitrage

Arbitrage is the simultaneous purchase and sale of an asset in different markets to profit from differing prices. With cryptocurrencies being highly volatile, price discrepancies often arise across exchanges.

Tools for Effective Trading

Trading tools can enhance your ability to monetize virtual funds. Here are some essential tools every trader should consider:

1. Trading Platforms

Choose a reliable trading platform that offers a user-friendly interface, advanced charting tools, and a wide range of cryptocurrencies. Popular platforms include Binance, Coinbase, and Kraken.

2. Portfolio Trackers

Utilizing portfolio trackers can help you manage your investments by offering real-time data on your holdings and performance metrics. Apps like Blockfolio or Delta provide insights to make informed decisions.

3. Trading Bots

Trading bots automate trading strategies to execute trades on your behalf. These bots work based on predefined parameters and can operate around the clock, seizing opportunities that human traders might miss.

Risk Management in Crypto Trading

Though there is potential for high rewards in crypto trading, the risks are equally significant. Implementing effective risk management strategies is crucial for safeguarding your investments and ensuring long-term success.

1. Position Sizing

Determining the correct position size for each trade is fundamental. It prevents significant losses that could impact your overall trading account.

2. Stop-Loss Orders

Setting stop-loss orders can help limit your losses on a trade. By specifying a price at which a position will automatically close, you minimize risk during downturns.

3. Diversification

Diversifying your cryptocurrency portfolio by investing in a variety of assets can mitigate risk and exposure to market volatility.

The Role of Community and Networking

Engaging with the crypto community can provide valuable insights and support for your trading journey. Joining forums, social media groups, and participating in local meetups can help you stay informed and connected.

Benefits of Community Engagement

- Shared Knowledge: Learn from experienced traders about strategies, tools, and market insights.

- Networking Opportunities: Build connections with fellow traders and potentially discover new trading partners.

- Moral Support: Trading can be a lonely endeavor—having a supportive community can help you stay motivated.

Staying Ahead in the Crypto Market

To continuously monetize virtual funds, you must remain adaptable and informed about market evolutions. Here are ways to stay ahead:

1. Continuous Learning

The cryptocurrency landscape is constantly changing. Engage in ongoing education through webinars, online courses, and reading materials to expand your knowledge.

2. Following Influencers

Identify and follow reputable figures in the crypto space. Influencers often share insights and opportunities that can enhance your understanding and trades.

3. Innovation Tracking

Keep tabs on new projects and tokens emerging in the crypto space. Investing early in innovative projects can lead to substantial returns.

Final Thoughts on Monetizing Virtual Funds

In the dynamic world of crypto trading, the potential to monetize virtual funds is significant for those who are well-informed and strategically driven. By investing time in research, utilizing effective tools, and implementing sound trading strategies, you can position yourself for success in this exciting marketplace.

With the combination of knowledge, community engagement, and a strong risk management strategy, there is no limit to what you can achieve in crypto trading. Embrace the journey, learn continuously, and seize the opportunities that come your way.

Always remember, while the allure of quick profits exists, success in crypto trading is built on perseverance, education, and a willingness to navigate the evolving market landscape diligently.