Health Insurance vs. Vision Insurance

Blog

Welcome to Baron Rick W Dr, your trusted source for all things related to eye health. In this article, we will delve into the often misunderstood realms of health insurance and vision insurance. Understanding the key distinctions between these two types of coverage is crucial, as it empowers you to make informed decisions about your healthcare needs. So, let's explore the intricacies of health insurance and vision insurance and how they complement each other.

What is Health Insurance?

Health insurance is a comprehensive form of coverage that protects you against the financial burden of medical expenses. It encompasses a wide range of services, including doctor visits, hospital stays, surgeries, medications, and preventive care. Health insurance is essential in providing access to quality healthcare and ensures that you receive the necessary medical attention when you need it the most. The cost of healthcare services can be exorbitant, and health insurance provides a safety net by covering a significant portion of these expenses.

What is Vision Insurance?

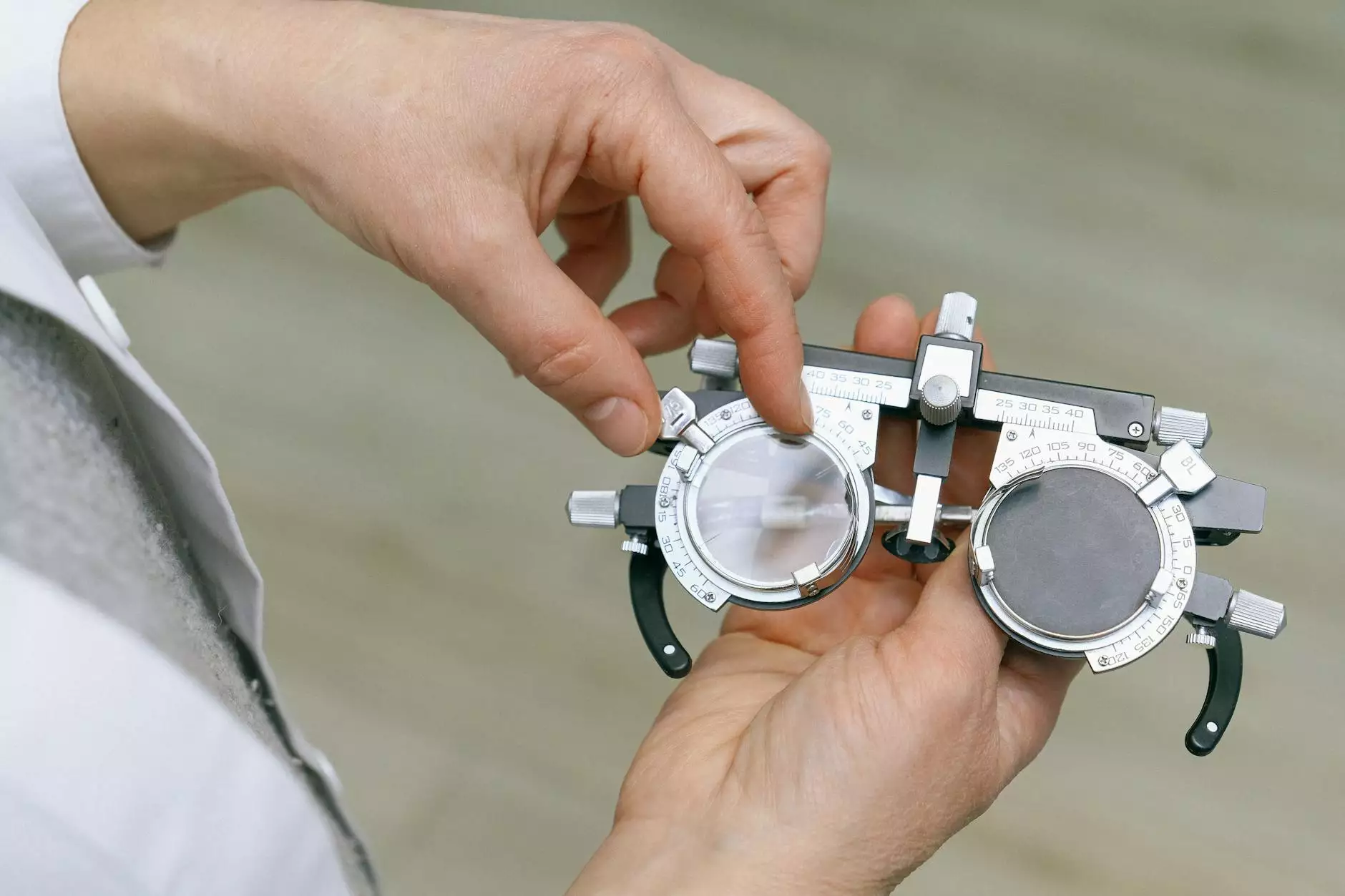

Vision insurance, on the other hand, is a specialized form of coverage that focuses specifically on eye care. While health insurance may provide some coverage for eye-related issues, vision insurance offers more comprehensive benefits tailored to your optical needs. Vision insurance typically covers services such as routine eye exams, prescription eyewear (glasses and contact lenses), and discounts on procedures such as LASIK surgery. With vision insurance, you can maintain optimal eye health, detect any potential issues early on, and ensure crystal-clear vision.

Key Differences

Now that we understand the basics of health insurance and vision insurance, it is essential to highlight the key distinctions between the two.

Coverage

Health insurance covers a broad array of healthcare services, including primary care, specialist visits, hospitalization, surgeries, and prescription medications. It aims to protect you from catastrophic medical expenses and provides financial stability in times of sickness or injury. On the other hand, vision insurance has a narrower focus and is specifically designed to address eye care needs. It provides coverage for routine eye exams, corrective eyewear, and discounts on vision correction procedures.

Cost

Health insurance premiums are typically higher compared to vision insurance premiums due to the broader coverage and higher costs associated with medical care. Health insurance often involves deductibles, copayments, and out-of-pocket maximums to manage costs. Vision insurance, on the other hand, generally has lower premiums and may offer additional benefits such as discounted frames or lenses.

Access to Providers

When it comes to health insurance, you have a wide network of doctors, hospitals, and specialists to choose from. It provides you with access to a comprehensive network of healthcare providers who can cater to your specific medical needs. With vision insurance, the network is usually more limited, and you may need to choose eye care providers within the network. However, vision insurance plans often offer the flexibility to visit an out-of-network provider at a higher cost.

The Importance of Having Both

While health insurance and vision insurance have their own unique benefits, having both types of coverage is crucial for holistic healthcare. Your eyes are an essential part of your overall well-being, and regular eye exams contribute to early detection and prevention of various eye conditions and diseases. By having vision insurance, you can ensure that you receive routine eye care and that any potential issues are identified and addressed promptly.

Furthermore, uncorrected vision problems can have a significant impact on your daily life, affecting your productivity, quality of work, and overall enjoyment. With vision insurance, you can easily obtain the necessary corrective eyewear, allowing you to see clearly and perform at your best.

In Conclusion

Understanding the distinction between health insurance and vision insurance is crucial for making informed decisions about your healthcare needs. While health insurance provides comprehensive coverage for all medical expenses, vision insurance specializes in eye care and offers benefits tailored to your optical needs. Both types of coverage play a vital role in safeguarding your health and financial well-being.

At Baron Rick W Dr, we understand the importance of comprehensive eye care, and we encourage you to explore different options available to you. By combining the protective shield of health insurance with the specialized benefits of vision insurance, you can ensure the best possible care for your eyes and your overall health.